By Ryan Downs

Students may be seeing a change in their federal and state based pay checks.

Making minimum wage — It’s arguably one of the most important things in the life of a student. For many it’s what keeps them busy while they’re in school. For many others, it’s the very thing keeping them in school. For countless individuals around the nation, it’s what’s keeping them alive. The minimum hourly wage that businesses are required to pay employees is a matter of economic importance not just for San Marcos, but for students everywhere and it may face some large changes in the coming months.

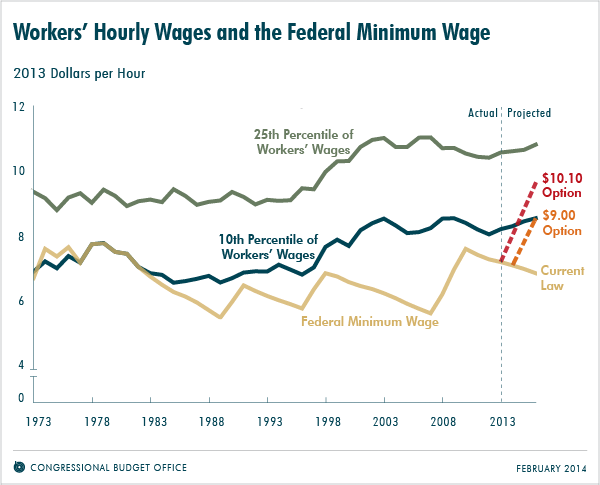

The issue of minimum wage became a talking point recently, after a report by the Congressional Budget Office elaborated on a plan by the President to raise the nationwide minimum wage from $7.25 an hour to $10.10, tentatively by the year 2016. It’s not too difficult to see why. In the last 14 years, the costs of education, gasoline, healthcare and living have all skyrocketed, whereas the wage has remained in a fixed position.

Naturally, this affects many individuals in the labor force, but not necessarily in a positive way. According to the CBO, while the wage increase could make lives easier for upwards of 16 million Americans, it is also slated to cost approximately 500,000 workers their jobs. In other words, the act would actually increase unemployment, the boon being that the already employed would make more money. This comes as a result of companies making less money when customers are less willing to spend on products that will be more expensive to pay for the workers.

However, the President remains optimistic, having acted as the primary force behind the bill since its inception. While the measure is expected to pass the primarily left-wing Senate in March, its odds of surviving the more right-wing House are decidedly less hopeful; with many representatives pointing out the rather harsh increase in unemployment.

It’s a fair comparison, while alleviating the effects of the recession on the more vulnerable in our society, the initiative could very well make the recession worse. Some economists beg to differ, like Pension Chairman Tom Harkin, who stated “workers benefit from modest increases in the minimum wage without negative consequences for the low-wage job market,” reminding individuals that an increase in revenue and circulation could very well increase job potential, cancelling out the increase in unemployment.

Still, the benefits to those suffering in the labor force are undeniable and the increase in circulation could very well allow the creation of new jobs. Ultimately, the fate of the measure depends on its standing in Congress at this point, which remains to be seen.

California’s minimum wage is itself scheduled to increase with from $8 to $10 in the course of three years due to a bill passed Sept. 12, 2013. It will increase in $1 dollar increments instead of in one wage hike.